How Did We Get Here? Part I: »

We Canadians live in one of the richest societies in the history of the world. A Canadian, John Humphrey, was instrumental in the creation of the 1948 Universal Declaration of Human Rights, including right to social security and a standard of living adequate for health and well-being – food, clothing, housing and medical care, necessary social services, and education. Canada pledged the full realization of these human rights. (1)

So, how is it that homelessness, hunger and food banks have proliferated and the scourge of child poverty remains in our midst? Affordable housing is out of reach for workers and the middle class in many of our cities. Over half of Canadians live paycheque to paycheque. Forty percent have no retirement savings.

Income inequality is at historic levels not seen since before the Great Depression. The top 1% gained a majority of national income before 2008 and gained almost all the additional income created in the so-called recovery. Why is this important? Increased inequality results in slower growth, lower GDP and greater instability. It undermines and threatens democracy. It breeds fear, resentment and scapegoating. In the aftermath of the horrors and lessons of the Second World War, US President Roosevelt warned:

“Necessitous men are not free men. People who are hungry and out of

a job are the stuff of which dictatorships are made. In our day these

economic truths have become accepted as self-evident.”

So, how did we get here, to an economy and political outcomes that are failing us?

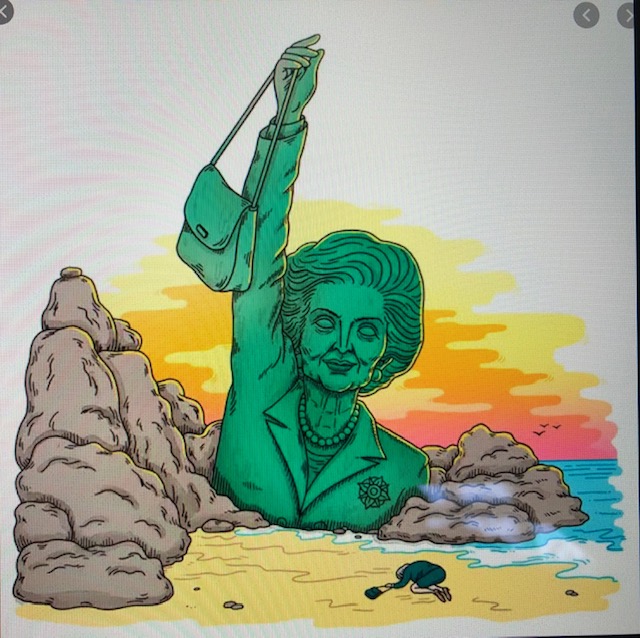

Margaret Thatcher said that, “there is no such thing as society and Ronald

Reagan said that government is not the solution to our problem; government

is the problem. These stupid slogans marked the turn away from the post-war

period of reconstruction and underpin much of the bullshit of the past forty

years.” – The New Yorker, May 2020.

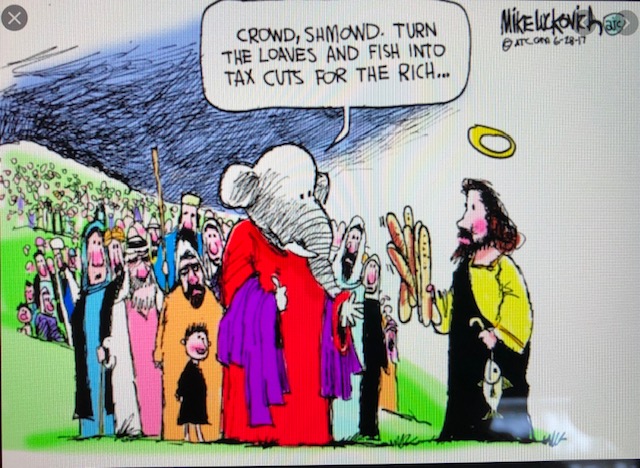

These are not accidental accretions, it is about values and ideology – power and influence of moneyed interests that dominates the political system, reinforces itself at every turn – for the benefit of the oligarchs and plutocrats, with their well-resourced think-tanks and media conglomerates.

For decades, the neo-liberals have demonized government and propagated a religion of tax cuts. Austerity at every level has eroded our key institutions and programs designed to help people.

[NYTimes.com, Illustration by Andrew Rae, 20-6-17]

In Canada, in 1982 the MacDonald Commission urged neo-liberal policy, calling for “free trade” and curtailing the welfare state. The 1987 Conservative budget cut taxes on the wealthy and NAFTA restricted the rights of the state to regulate business and corporations. The 1995 budget included a 40% cut in transfers to provinces by 1997 – for health, welfare and education. Paul Martin and the Liberals abandoned Keynesian economics. In 2000, the Liberals broke their promise to restore 50% of future budget surplus to restore funding cuts, instead cutting $100 Billion in taxes over 5 years. More than 30% of the tax cuts went to the top 5% of income earners and more than 70% to the top 30%. Corporate taxes were cut more than 35%. Cuts to unemployment and welfare impacted the provinces ability to reduce poverty. (2)

The deficit scare was used to justify and mobilize political messaging for the actions taken. Other OECD countries such as Finland, Denmark, the Netherlands, and Australia reduced their deficits less quickly than Canada, but neither did they reduce their national government spending to the degree Canada did, as a percentage of the economy.

For a brief interlude in 2004, the NDP led by Jack Layton was able to pressure a Liberal minority government to reverse a proposed $4.6 Billion cut in corporate taxes to instead spend money on affordable housing, public transit and education.

The election of the Harper Conservatives accelerated the attack on the progressive state. Child-care program cuts were accompanied by a cut in the corporate tax from 22% to 15% resulting in $10 Billion reduction in government revenues within 3 years. The political optics of boutique tax cuts resulted in disproportionate benefits to those with higher incomes. The GST was cut 2% with a loss of $15 Billion in annual government revenue, while it may have been politically popular, polls suggested it have been better used to fund infrastructure to cities and towns. By 2010, the Conservative finance minister boasted that the federal tax revenue to GDP was the lowest since 1961 – an era prior to the great nation building programs such as Medicare, Canada Pension Plan, Old Age Security, Employment Insurance, expanded post-secondary education and social assistance. (3)

Tax cuts do not pay for themselves. The incomes of average Canadians have stagnated for the past 40 years, the benefits have gone hugely to the top percentile, accompanied by cuts to public services vital to the well-being and progress of the country and it’s people. There has been a massive increase of income inequality and a growing disconnect by the top 1% to the struggles and needs of the majority of the population.

What lessons can be learned from the financial crisis of 2008 and the crisis of COVID-19? Why should it matter?…It threatens social stability and undermines democracy. We require a bold way forward to a new economy and political choices that are better for the Canadian people and the country, a more promising, egalitarian and prosperous future.

Some ideas to accomplish this, will follow in Part II…

(1) Articles 22 & 25; (2) Source: Alex Himelfarb & Jordan Himelfarb, editors, “Tax is Not a Four Letter Word, A Different Take on Taxes in Canada”, Wilfred Laurier University Press, 2013. (3) ibid.

Bill Sundhu

Bill Sundhu is a Canadian lawyer and former judge with more than 35 years of experience in the courts of justice.

His current practice includes trial and appellate advocacy in criminal justice, human rights and civil liberties. Bill has broad legal experience that includes criminal justice, family law, child and youth law, indigenous rights, police misconduct and wrongful deaths, non-discrimination, access to justice, law reform and legislation, professional legal responsibility, and judicial independence and administration.

He is a regular speaker, lecturer and media commentator on human rights, justice, diversity, equality and international legal issues. He has extensive knowledge of the Canadian justice system and international human rights law, with particular interest in international criminal law.

Bill has three university degrees, including a Masters degree in International Human Rights Law from Oxford University. He practices in Canadian and International Law.

His work is recognized by appointment to the List of Counsel for the International Criminal Court in the Hague (war crimes, genocide, crimes against humanity) and selection to a panel of international experts to train judges in Tunisia, in 2013-14 in human rights and administration of justice. He has served an extensive term as an Executive Member of the Canadian Bar Association National Criminal Law Subsection.

Bill is a founding member of the BC Association of Multicultural Societies and is an advocate for equality and diversity. He and his family have made Kamloops, British Columbia, their home for the past 24 years.

My Blog Posts Visit My Website