The Failures & Dangers of the Pre-Pandemic Economy, Part II: Retrenchment or Reset? »

“May you live in interesting times”: an ancient saying attributed to the Chinese. Ironically, it is a curse that life is better in “uninteresting times” of peace and stability than times of trouble and turbulence. We are now in “interesting times”, COVID-19 has profound global impact and shocked us out of complacency.

The virus has exposed the gaping holes of our economic and social system. The prosperity and stability of the post WW II era in western countries was eclipsed by a pre-pandemic economy that failed us in many ways, resulting in gross income inequality and insecurity of precarious work. Middle class and worker incomes have stagnated while huge swaths of wealth are more and more held in the hands of the few – the top tier, the 1%. In turn, billionaires buy influence and dominate political and economic power.

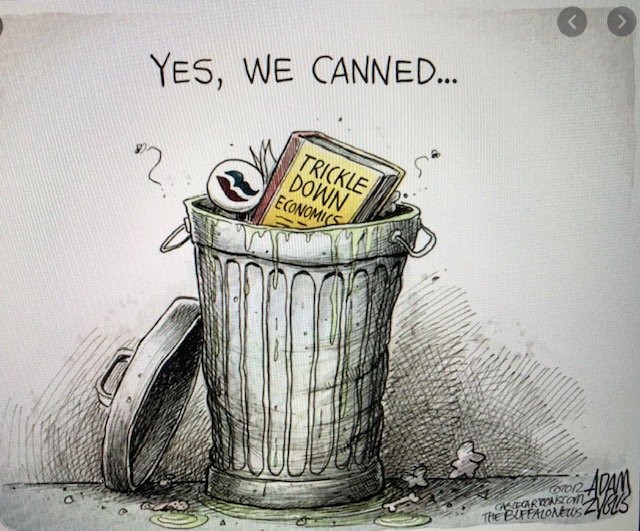

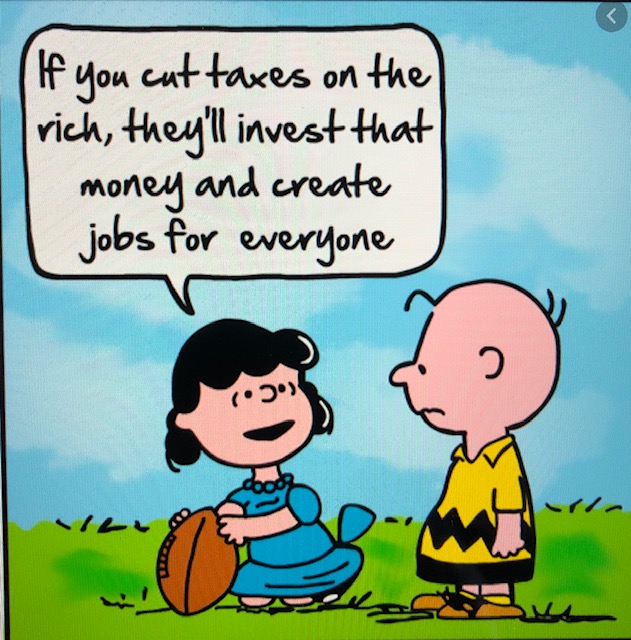

Governments that embraced neo-liberal ideology slashed spending and taxes, outsourced to the private sector, relaxed regulation and eroded public health and services – whilst lacking the resources required at hand at a time of urgent need.

The ideological denigration of government and public institutions has contributed to public cynicism – voter turnout declined and the insidious role of private money further accelerated the capture of political power and levers of government. Economic insecurity has provided fertile ground for fear and division, the scapegoating of minorities and immigrants and the rise of diversionary dog-whistle politics or worse – demagogues and authoritarianism – such as Trump, Bolsanaro, Orban and Erdogan.

COVID-19 has accelerated exposure of the inequities and fears. We are at historic crossroads. Which direction will we go? That’s a tough one – it could go either way. Does it risk economic depression or calamity with governments choosing more austerity? Already powerful voices are calling out the deficit and “debt” – for a retrenchment. Or, does it show that the right has little to offer after decades of “Government get out of the way!” and the worship of the market. In Canada, New Zealand, Scandinavia, and Germany, among others, we are witnessing collective action, government and the public sector reiterating the role of government in crisis and helping their people to survive and get through the crisis.

Canada is rich country. It’s also clear we always had the resources. The pandemic has exposed “ugly truths”. Polls show four-in-five Canadians agree COVID-19 has revealed problems of the elderly and vulnerable Canadians and troubling inequality in our society. This is the result of choices and ideology – of priorities and values, of how resources and wealth is apportioned in society.

Governments have the capacity to help shape a better future. Public investments and strategic initiatives in infrastructure, public transit and universal broadband, pharmacare and dental care, diversification with renewable energy and a Green New Deal, affordable housing, improved minimum wage and benefit standards, ensuring supply chains and food security vital to national security, training and supports to transition displaced workers and education investments for a modern and adaptable workforce, a national strategy to address an aging population and child poverty, and universal child-care.

“How will you pay for it?” critics will opine. How much are we willing to pay to live in good and prosperous country? By reforming the taxation system and making it fair and progressive. Challenging the view that any tax is a bad tax. We could consider:

- A wealth tax: A well-designed wealth tax would address risk of wealth transfers out of country and contribute back to the health and well-being of a society that has provided the wealthy so much;

- An inheritance tax: The boomers, the largest demographic sits on substantial assets to be bequeathed and a modest inheritance tax would support growing demands on health care and assist the younger generation which will bear the burden of supporting an economy with a demographically aging population;

- Raise the GST 2% back to 7%, before Harper cut it and generate $15B annually;

- Close unfair legal tax loopholes and create an elite division to aggressively go after large-scale tax evasion and offshore tax havens. PBO conservatively estimates $240B Canadian stashed away in tax havens and $25B annually leaving the country;

- Consider increasing the capital gains tax to back 75%, before Liberals reduced it. Why should human labour be taxed fully and capital less so?

- Incentivize and reward innovation. End subsidies to fossil fuel and polluting industries;

- Create a National Commission, like the Carter commission more than 50 years ago, to modernize the entire tax system. The economy, technology and society have changed drastically since then. This is long overdue.

As for the national debt, we should not be fooled by the old scare “the cupboard is bare”. Borrowing costs for government are extremely low, governments have a very long time frame to manage debt and much of the debt we are adding is owed to ourselves. The Globe & Mail editorial, “At no time in history has Canada been able to borrow so much for so little. Which is fortunate, because at no time since the last war has Canada needed to borrow so much, so quickly.”1 Increasing revenue permits strategic investments, avoiding drastic and brutal cuts, and reduces the debt.

“The ideological denigration of government and public institutions….Economic insecurity has provided fertile ground for fear and division, the scapegoating of minorities and immigrants and the rise of diversionary dog-whistle politics or worse – demagogues and authoritarianism – such as Trump, Bolsanaro, Orban and Erdogan.“

The evidence and research is clear, we pay a high price for inequality. And, it is dangerous. It breeds resentment which in turn fuels anger and extremism. The more equal a society, the more successful it is. Conversely, “almost everything – from life expectancy to mental illness, violence to illiteracy – is affected not by how wealthy a society is, but how equal it is.” (Pickett & Wilkinson). Even the IMF is warning states to raise taxes on the wealthy to tackle inequality. (7-1-20) The success of post war Keynesian economics may be making a comeback.

This is a revolutionary moment in politics, the choices we make will shape political direction and societal views on policy issues for decades. This is the time for swift and meaningful change – a Great Reset. Good ideas and beliefs are not enough, it requires organized and collective action. Progressives must be ready for the challenge. Let the debate begin. Our collective future will depend on it.

- Globe & Mail, 28-4-2020

- Wilkinson & Pickett, The Spirit Level, Why Equality is Better for Everyone, Penguins Books, 2010.

Bill Sundhu

Bill Sundhu is a Canadian lawyer and former judge with more than 35 years of experience in the courts of justice.

His current practice includes trial and appellate advocacy in criminal justice, human rights and civil liberties. Bill has broad legal experience that includes criminal justice, family law, child and youth law, indigenous rights, police misconduct and wrongful deaths, non-discrimination, access to justice, law reform and legislation, professional legal responsibility, and judicial independence and administration.

He is a regular speaker, lecturer and media commentator on human rights, justice, diversity, equality and international legal issues. He has extensive knowledge of the Canadian justice system and international human rights law, with particular interest in international criminal law.

Bill has three university degrees, including a Masters degree in International Human Rights Law from Oxford University. He practices in Canadian and International Law.

His work is recognized by appointment to the List of Counsel for the International Criminal Court in the Hague (war crimes, genocide, crimes against humanity) and selection to a panel of international experts to train judges in Tunisia, in 2013-14 in human rights and administration of justice. He has served an extensive term as an Executive Member of the Canadian Bar Association National Criminal Law Subsection.

Bill is a founding member of the BC Association of Multicultural Societies and is an advocate for equality and diversity. He and his family have made Kamloops, British Columbia, their home for the past 24 years.

My Blog Posts Visit My Website